1099-r box 14 state distribution There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT . Create a sleek white kitchen with stainless steel appliances for a clean and modern look. Incorporate a farmhouse style into your white kitchen by pairing rustic stainless steel fixtures with crisp cabinetry.

0 · is a 1099 r taxable

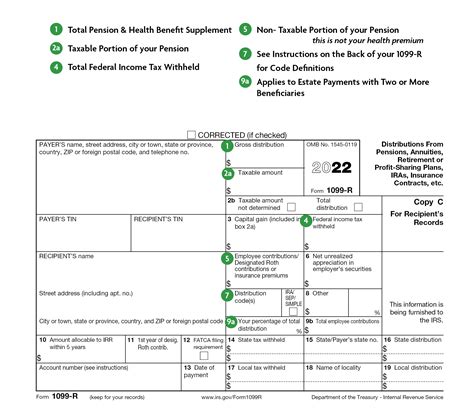

1 · irs 1099 r distribution codes

2 · irs 1099 r 2023

3 · internal revenue service 1099 r

4 · gross distribution on 1099 r

5 · 1099 r form pdf

6 · 1099 r boxes explained

7 · 1099 r box 16 blank

You can pair white appliances with all white cabinets for a light and bright kitchen or opt for colorful cabinets to make your white appliances pop. White appliances are great for farmhouse-style kitchens but can also provide a more modern look too.

is a 1099 r taxable

There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT has highlighted, is greater than empty Box 15 titled State distribution. Additionally, the amount highlighted in Box 14 IS less than box 1 Gross distribution.

irs 1099 r distribution codes

There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT .TurboTax is here to make the tax filing process as easy as possible. We're .

Find TurboTax help articles, Community discussions with other TurboTax users, .We would like to show you a description here but the site won’t allow us.If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution .

If you do not have an amount in Box 14 (State tax withheld) of the 1099-R, delete any entries you may have in boxes 15 (Payer's State/State No.) and 16 (State distribution). If .

In this article, we’ll walk through IRS Form 1099-R, including: A comprehensive look at what you should see in each box of this tax form; Distribution codes that may apply and how to understand them; Other . In both the online and download versions TurboTax shows Box 12 as "FATCA filing requirement box is checked" and Box 14 as "State Tax Withheld." If you are using the .

irs 1099 r 2023

internal revenue service 1099 r

gauge table sheet metal

Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.

What is a 1099-R? A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts, many of which are retirement savings accounts. You’ll generally receive one for distributions of .

For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a . 1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is .

Death benefit lump sum (or 1959 survivor rollover) distribution made to a decedent's beneficiary or survivor, including their trust or estate. Indicates the amount reported is a death benefit lump sum distribution which may be .My state tax filing is being held up by Turbo-tax who is asking me to check my FORM 1099-R because State tax was withheld but no state distribution amount was entered by the issuer of the 1099-R. Message from Turbo tax states: Check this Enty: Form 1099-R: Box 12a For electronic Filing, New York State withholdings cannot be greater than or equal to gross distribution or .

On my 1099-R Box 12 is "FATCA filing requirement" and box 14 states "State tax withheld", turbo tax calls box 12 "amount withheld" and box 14 "State distribution amt" Apparently there's something wrong herewith turbo tax. If your 1099-R has a state withholding in Box 14, you must enter Line 15 and 16 as well. If your 1099-R does not have a state payer number, it is possible that they do not have one. Not every payer of retirement distributions has obtained payer numbers for every state. You should try and contact the payer for their NY state identification number. 2) A CSF- or CSA-1099-R from OPM has State "withholding" in box 12 and total state distribution in box 14. ____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

@Tpaoli70 1099-R box 14 is state tax withheld. Box 15 is the state and ID. Box 16 is the distribution amount. If you are a full year resident, you can use your box 2a amount in box 16. NOTE: prior to 2020 the state tax was in boxes 12-14, 2020 renumbered those boxes to 14-16. Box 16 is not usually required because it has been an 1099-R industrial standard for many years that if there is only one state in box 14 & 15 then the box 1 amount does not need to be allocated between two states - the entire box 1 amount is understood to be the state . Thanks to all for weighing in on the 1099-R Box 14 New York State fiasco. I got hung up on this last year and had to file an amended paper return to NYS. I brought this issue up to both NYS and TurboTax. I just received my 2019 Fidelity 1099-R. Box 1-2 = 00, Box 12 = 80, Box 14 blank. According to NYS, Box 12 cannot be greater or equal to .

If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State ID number, so that Boxes 14, 15, and 16 are blank. See this article for more information on Form 1099-R. Box 16 is the state amount of the distribution. In most cases it is the same as Box 1 - gross distribution. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. Enter the following in Box 16: If Box 14 shows State Tax withheld, enter the amount in Box 1 (gross distribution);1099-R Box 14a for efiling New York State withholdings can not be greater than or equal to gross distribution or state distribution (nothing in box 16 on my form). Yes. Box 14 (State Tax Withheld) is the same as Box 1 (Gross Distribution).

My state tax filing is being held up by Turbo-tax who is asking me to check my FORM 1099-R because State tax was withheld but no state distribution amount was entered by the issuer of the 1099-R. Message from Turbo tax states: Check this Enty: Form 1099-R: Box 12a For electronic Filing, New York State withholdings cannot be greater than or equal to gross distribution or .

On my 1099-R Box 12 is "FATCA filing requirement" and box 14 states "State tax withheld", turbo tax calls box 12 "amount withheld" and box 14 "State distribution amt" Apparently there's something wrong herewith turbo tax.

If your 1099-R has a state withholding in Box 14, you must enter Line 15 and 16 as well. If your 1099-R does not have a state payer number, it is possible that they do not have one. Not every payer of retirement distributions has obtained payer numbers for every state. You should try and contact the payer for their NY state identification number. 2) A CSF- or CSA-1099-R from OPM has State "withholding" in box 12 and total state distribution in box 14. ____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

@Tpaoli70 1099-R box 14 is state tax withheld. Box 15 is the state and ID. Box 16 is the distribution amount. If you are a full year resident, you can use your box 2a amount in box 16. NOTE: prior to 2020 the state tax was in boxes 12-14, 2020 renumbered those boxes to 14-16. Box 16 is not usually required because it has been an 1099-R industrial standard for many years that if there is only one state in box 14 & 15 then the box 1 amount does not need to be allocated between two states - the entire box 1 amount is understood to be the state . Thanks to all for weighing in on the 1099-R Box 14 New York State fiasco. I got hung up on this last year and had to file an amended paper return to NYS. I brought this issue up to both NYS and TurboTax. I just received my 2019 Fidelity 1099-R. Box 1-2 = 00, Box 12 = 80, Box 14 blank. According to NYS, Box 12 cannot be greater or equal to .

If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State ID number, so that Boxes 14, 15, and 16 are blank. See this article for more information on Form 1099-R. Box 16 is the state amount of the distribution. In most cases it is the same as Box 1 - gross distribution. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. Enter the following in Box 16: If Box 14 shows State Tax withheld, enter the amount in Box 1 (gross distribution);

gross distribution on 1099 r

1099 r form pdf

Our favorite farmhouse house plans and architects that combine simple rustic charm with modern architecture. Customize your floor plan and buy direct.

1099-r box 14 state distribution|gross distribution on 1099 r